In early October 2020, the Government released their 2020-21 Budget which included some significant changes to the R&D Tax Incentive (RDTI) program. The changes were received well, especially in the start-up community. However, the actual effect of the changes and their presentation in the official documentation could be a little hard to digest and make sense of.

To help unravel the announcement and really understand the impact of the changes, and why they are so good, it is useful to understand the context in relation to two key points:

1. Existing Law

There was an existing law in place since the program was introduced in 2011. This was covered by Tax Laws Amendment (Research and Development) Act 2011.

2. Proposed Changes

The Treasury Laws Amendment (Research and Development Tax Incentive) Bill 2019 was introduced to Parliament in December 2019 prior to the Budget announcement.

The Bill was proposing to change the law to reduce the RDTI benefit to 13.5% above the company tax rate. This Bill proposed to make change retrospectively from 1st of July 2019.

How the Budget Changes Things

The most recent Budget introduced changes to the R&D Tax Incentive that would replace the existing law and override the proposed Bill (explained in points 1 and 2 above).

The Treasury Laws Amendment (A Tax Plan for the COVID-19 Economic Recovery) Bill 2020 was introduced into Parliament and passed on 9 October 2020. Changes apply from the 1st of July 2021.

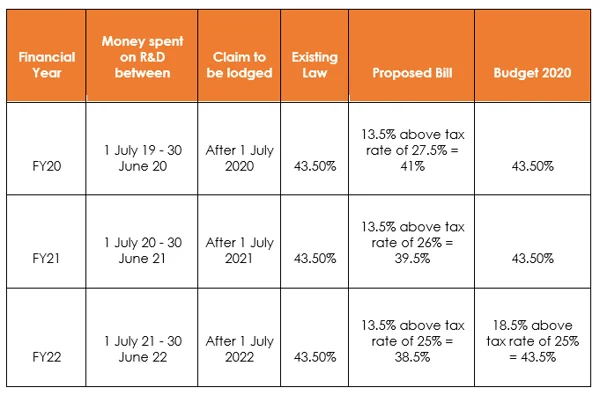

The table below summarises what the R&D Tax Incentive benefit is under all three scenarios for each financial year.

Note: this only applies to companies with aggregate turnover under $20m.

Ultimately, the net effect is that the refundable tax offset companies receive from the RDTI essentially remains the same – 43.5%. However, there is reason to celebrate:

1. This is far better than the 38.5% the proposed Bill was going to reduce the benefit to.

2. There will be no retrospective changes for companies that have already spent money in the FY20 year, as the new Bill was proposing to do.

Not only is the increased rate important, but so is the stability the Budget gives to companies in knowing that the Government intends to continue to support innovation through research and development as the country works its way out of the pandemic.

Gary Shapiro is the Co-MD at Rimon Advisory, a leading Australian R&D Tax Incentive and Export Market Development Grant consulting firm.

He is a qualified engineer and is a registered Tax Agent. Gary is also currently a PhD candidate at the University of Sydney in the Faculty of Engineering.