R&D Tax Incentive Benefits Explained

- By Lior Stein

- •

- 27 Oct, 2020

Often the benefits of the R&D tax incentive are misunderstood.

Is it a super tax credit, cash back or extended loss?

Is the R&D benefit 43.5% or 38.5%? I have also heard 16% and 13%?

The truth is, all of the above are correct, but in different scenarios.

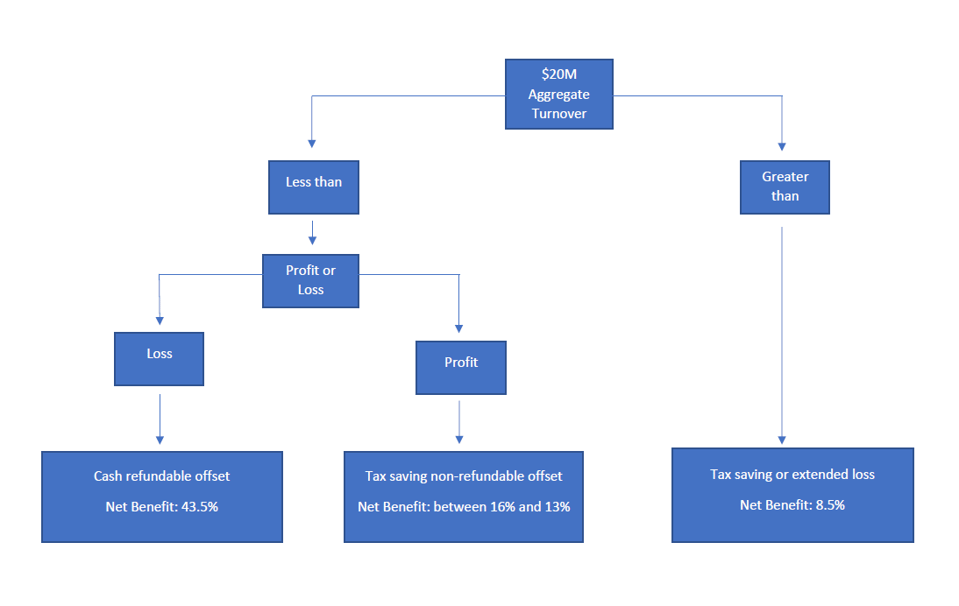

The first point to consider is if your business is below or above the $20 million aggregate turnover threshold. Below is a table to show the differing benefits and a guide to help you ascertain which category you fall in to.

| R&D Tax Incentive | |||

| TURNOVER | BENEFIT | LOSS MAKING | PROFIT MAKING |

| < $20 million turnover | 43.50% | cash-refundable | non-refundable |

| > $20 million turnover | 38.50% | non-refundable | non-refundable |

Think you might be eligible? We have put together some basic questions for you to quickly find out!

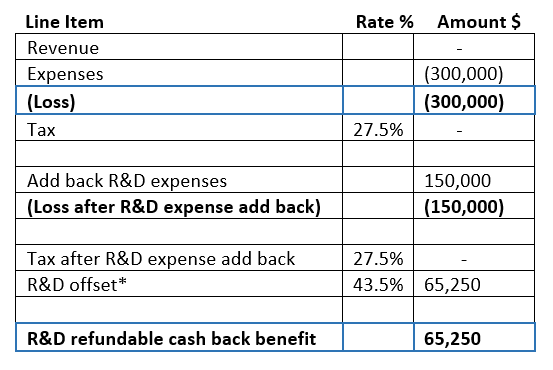

BENEFIT 1: CASH BACK BENEFIT

The refundable cash back benefit is reserved for loss making entities.

Explained briefly, if your company has enough current or accumulated losses (losses from prior operating years) available, then the R&D tax incentive allows the company to “dip into” its losses and “cash them in” in the current year as opposed to waiting until future, profit making years, in order to not pay tax.

This benefit is an absolute lifeline to innovative companies who are yet to break even or are in a pre-revenue stage.

Our example below assumes zero revenue, however, the same principles can be applied to companies with revenue who have current or accumulated losses.

*The R&D offset is calculated by taking the R&D eligible expenditure (in this example that figure is $150,000), and multiplying it by the appropriate R&D tax incentive rate of 43.5%. Our example entity would have received $65,250 in cash from utilizing the R&D tax incentive.

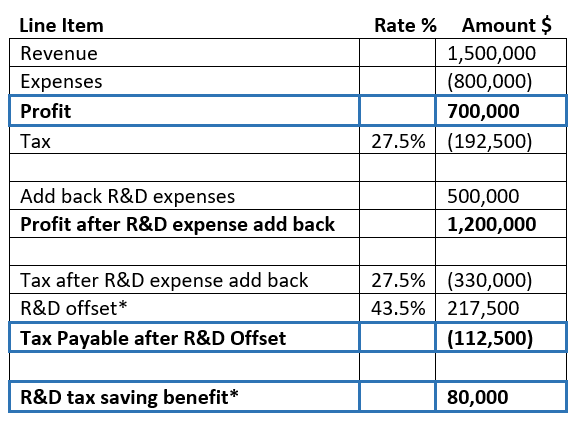

BENEFIT 2: TAX SAVING BENEFIT ENTITY < $20M in AGGREGATE TURNOVER

*In our example we have a revenue and profit-making entity with an aggregate turnover of less than $20M. The R&D offset is calculated as 43.5% of the R&D expenditure of $500,000 giving us an offset of $217,500.

The R&D benefit is calculated as the original tax payable by the company of $192,500 less the tax payable after utilizing the R&D tax incentive being $112,500. This yields a net R&D benefit of $80,000 which will be realized as a tax saving.

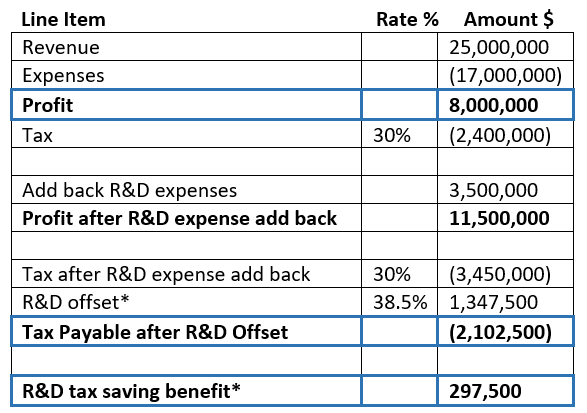

BENEFIT 3: TAX SAVING BENEFIT ENTITY > $20M in AGGREGATE TURNOVER

*In our example we have a revenue and profit-making entity with an aggregate turnover of greater than $20M. The R&D tax incentive benefit for an entity with > $20M in aggregate turnover changes to 38.5% and that entity is not eligible for the refundable cash back benefit.

In other words, the R&D benefit for such an entity is restricted to a non-refundable tax saving or extended losses. The R&D offset is calculated as 38.5% of the R&D expenditure of $3,500,000 giving us an offset of $1,347,500.

The R&D benefit is calculated as the original tax payable by the company of $2,400,000 less the tax payable after utilizing the R&D tax incentive being $2,102,500. This yields a net R&D benefit of $297,500 which will be realized as a tax saving.

An important point to note is that as of the 2022 Financial Year the benefit for companies with > $20M changes to a new 2-tiered approach. This approach will be explained in a separate article.

Our experiences at Rimon Advisory have shown that the R&D grant has been exceptionally beneficial to our clients of all sizes, from early stage companies, to established SMEs all the way through to listed entities.

Lior Stein is the Co-MD at Rimon Advisory, a leading Australian R&D Tax Incentive and Export Market Development Grant consulting firm.

He is a Chartered Accounting by profession but an Entrepreneur by passion.

Lior is a member of the Australian Institute of Chartered Accountants (ICAA) and The Tax Institute.

You may be interested to know if your business could use the R&D Tax Incentive.

We have put together a few quick questions for you to be able to assess your eligibility.

Click below if you want to know more: