The Export Market Development Grant (EMDG)

The Export Market Development Grant is Australia’s leading government funding initiative to increase Australian Exports in foreign markets. The programme has seen huge success since its inception in 1974.

The main purpose of the grant is to give a cash flow boost to Australian businesses exporting their products or services overseas via a government grant of up to 50% of all eligible marketing, branding and lead generation expenses.

Below is a summary of all the important points you need to know in the EMDG guidelines.

R&D Tax Incentive and Export Market Development Grant Experts

Who can claim the Export Market Development Grant

In order to claim EMDG, you will need to be an ‘eligible person’who is ‘ready to export’, with an ‘eligible product’

The EMDG is a programme aimed across all verticals and is industry agnostic.

The grant supports a wide range of industry sectors and products, including the export of intellectual property and knowhow as well as allowances for export of Australian products manufactured overseas.

AusTrade (the body governing the grant) wants to encourage small and medium sized Australian entities to develop export markets.

The grant is for Australian entities with Australian Products or Australian Services who are currently or aspiring to export their products or services to export markets.

EMDG Entity Eligibility

AusTrade, The Australian Trade and Investment Commission, are responsible for promoting trade, investment and international education between Australia and foreign countries. The Export Market Development Grant is AusTrade’s #1 programme for financially supporting the country’s export industry.

To be eligible, the business must have:

- Income of not more than $20 million in the grant year

- principal status for the export business (some exceptions apply, such as non-profit export-focused industry bodies)

What types of businesses are Eligible to make a Claim

To apply for the Export Market Development Grant, you are not required to be an incorporated entity. These entities need to intend to carry on export activities during the year for which they seek an Export Grant

Any Australian individual

Statutory corporation

Co-operative

Partnership

Company

Trust

What Marketing Expenses can be Claimed

There are 10 claimable categories in the EMDG scheme:

EMDG categories | |

|---|---|

CATEGORY | EXPENSE EXAMPLE |

Overseas Representative | Sales People / Team Overseas |

Marketing Visits (foreign countries) | Flights, Daily Food & Hotel Allowance overseas |

Marketing Visits (within Australia) | Flights, Daily Food & Hotel Allowance domestically |

Marketing Consultants | PR / Marketing / Online / Social Media |

Foreign Buyer Visits | Flights, Accommodation, Food |

Soliciting for business in foreign country | Conferences, Trade shows and networking events |

Free Samples | Free Samples |

Promotional Literature & Advertising | Google Ads, Facebook Ads, Instagram Ads, Photoshoots, Printed Material, Magazines |

Intellectual Property | Registration &/or Insurance |

Eligible expenses of a person in respect of training activities | Only for Tier 1 agreements and representative bodies |

What is the Cash Benefit Available

The new guidelines break the benefit up into 3 separate Funding Tiers.

Each tier is eligible to 50% of their eligible and authorised spend.

The grant amounts and lengths of grant agreements varied for Rounds 1, 2 and 3. There are no current rounds open. Round 5 is not currently open. See Grant round updates on this page.

High Level Summary Of The 3 Tiers

Min Turnover | Max Grant | Max Authorization | Tier Description | |

|---|---|---|---|---|

Tier 1 | $100,000 | $30,000 | 2 years | New Export Activities |

Tier 2 | $500,000 | $50,000 | 2 years | Expanding Export Activities |

Tier 3 | $1,000,000 | $80,000 | 2 years | Strategic Shifts to Export Activities |

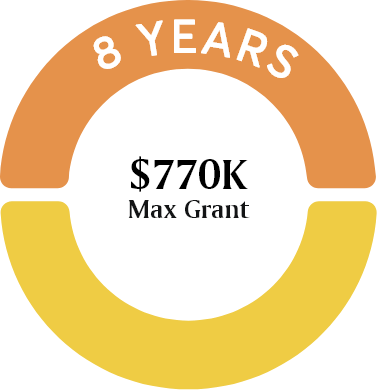

The Grant can be used on 8 separate occasions with an upper limit of $770,000 per business in aggregate over the 8 years.

Any previous submission would need to be included in these 8.

What is a Grant Year

- A Grant Year is a financial year in which the intended marketing expenses fall within

- Eligible expenses to be incurred within a Grant Year will form part of the Plan to Market Document

What Is The Audit Process

Rimon Guides You Through Every Step of the Process

01

Initial Assessment and Onboarding

- EMDG 3 principle assessment

- Company structure compliance

- Financial expenditure assessment

- Signing proposal & confidentiality agreement

- Introduction to the Rimon team

02

EMDG Workshop

- Understand the client

- Begin storytelling

- Identify risk areas

- Explain next steps

03

Claim Kickoff

- Conceptualise and articulate the client’s story

- Request financial information

- Analyse financial information and identify eligible expenditure

- Iron out any risk areas

04

Claim Upload and Submission

- Detailed internal review

- Upload the entire claim to the submission portal

- Final review before submission

- Submission of claim to AusTrade

What are the Application Window Timeframes

An Application Window is a timeframe in which a submission must be made within.

If the Application is missed then the grant for that Grant Year is lost.

There are no grant rounds currently open for applications. The EMDG information on the Austrade website applies to Rounds 1, 2 and 3. Austrade will communicate all changes when the program details, including guidelines, are finalised and released.

Application Window dates

Grant Year | Applilcation Window |

|---|---|

Rounds 1 (2021), 2 (2022) and 3 (2023) | Closed to new applicants |

Round 4 (2024) | Closed |

Round 5 | Not currently open |

What is a Plan to Market Document

A new concept termed a Plan to Market Document is required to be submitted.

All applications will require a plan to market. This will be a detailed and comprehensive outline and forecast of the intended foreign expansion plans of the business.

This plan to market document will show AusTrade what you intend to do to market your product overseas in the next 2 years, and why.

The plan to market would look to answer the following:

-

Why are you undertaking the proposed marketing?

In other words, what business goals are you seeking to address through your marketing? - How will you measure success?

- What is your overall budget for each financial year?

- Where and what customers or demographic will your marketing be targeted towards?

- What marketing activities will you undertake?

The marketing plan and budget will be inspected and reviewed by Austrade in the process of assessing the eligibility for being pre approved for the Export Market Development Grant under the new guidelines.

Your plan to market will show Austrade your export intentions and how you plan on dominating the market over the next 2 years. Your plan will highlight an array of topics from budgets to business goals and will allow Austrade to form an opinion of where your business stands

The Plan to Market Document will be the initial factor in deciding which Funding Tier the submission will fall into.

If approved AusTrade will enter into a Funding Agreement with the applicant.

What is a Funding Agreement

Austrade will offer a grant agreement to each applicant who is eligible to receive a grant. This grant agreement sets out the terms and conditions for your grant, including the amount of funding you will receive.

Once decided, this will be the maximum amount of funding you can receive, even if you end up spending more than the agreed amount. If for some reason you spend less than the agreed amount, Austrade will only pay 50% of your total eligible marketing spend.

Explaining the Funding Tiers.

Tier 1

Newcomers to Exporting

Typically for businesses that have a product or service but haven’t “dipped their toes” into overseas markets to date.

The following 2 statements would apply to you:

- Have not previously exported eligible products; and

- Have a plan to market or the knowhow in marketing overseas through completing either:

- Austrade’s export readiness tool (check eligibility link); or

- You have completed export readiness training

A Tier 1 entity may spend up to $60,000 and could qualify for up to $30,000 in Export Grant Funding per claim.

A Tier 1 application could be authorised for a maximum 2 year pre-approval.

Tier 2

Expanding Current Export and Promotion Activities

Typically for businesses that have trialed foreign marketing and advertising spend.

The marketing has met some success and now has sparked an interest in increasing marketing spend.

The following 2 statements would apply to you:

- Already exporting their eligible products & are

- Expanding their export promotion activity

A Tier 2 entity may spend up to $100,000 and could qualify for up to $50,000 in Export Grant Funding.

A Tier 2 application could be authorised for a maximum 2 year pre-approval.

Tier 3

Making Strategic Marketing Shifts

Typically for businesses entities with experience marketing to foreign markets and are looking to add a new pivot to their existing marketing efforts and campaigns.

An example of this would be launching a new product or marketing a new campaign.

The following 3 statements would apply to you:

- Already exporting their eligible products, are

- Expanding their export promotion activity as well as

- Making a strategic shift

A strategic shift represents a change in your business strategy including operational and/or supply chain readiness that supports changing your marketing or promotional activities to target a new export market (defined as a single economy).

For Tier 3 applicants, your marketing and promotional activities must shift beyond your existing markets (economies), to additionally target one or more of the key markets (economies) listed:

- Bangladesh

- Brunei Darussalam

- Cambodia

- Canada

- China

- Fiji

- France

- Germany

- Hong Kong

- India

- Indonesia

- Italy

- Japan

- Laos

- Malaysia

- Netherlands

- Papua New Guinea

- Philippines

- Singapore

- South Korea

- Taiwan

- Thailand

- Timor-Leste

- United Arab Emirates

- United Kingdom

- United States

- Vietnam

How is the Benefit Paid

To assist with cash flow the grant has moved over to “Milestone payments”.

It’s important to note that AusTrade expects an applicant to be able to finance the marketing budget that is put forward on their own accord.

The Grant is then applied and distributed as a further financial boost.

The process will be in 2 steps:

- An Application window is going to open and give everybody an opportunity to submit their claim to Austrade.

- Austrade are going to review your claim & enter into an agreement with you, commonly referred to as a ‘funding agreement’, which will last either 2 or 3 years.

- Your funding agreement will indicate your tier level, the different planned expenses and the various milestone payment dates.

- At the various Milestone dates, Austrade will review your progress and make certain milestone payments based on your funding agreement.

Who is the Governing Body

The Australian Trade and Investment Commission – Austrade – is Australia’s leading trade and investment agency.

They are experts in connecting Australian businesses to the world and the world to Australian businesses.

AusTrade is the governing body that administers the Export Market Development Grant.

Who is an Eligible Person

- An individual whose principal place of residence is in Australia

- A body incorporated under the Corporations Act 2001

- An association incorporated under an Australian law

- A partnership that is Australian, that is if the partnership was formed and operates under a law of a State or Territory, and at least half the partners are Australian persons

- A trust that is Australian within the meaning of the EMDG Rules, that is the trustee, or each trustee, of the trust is an Australian person

- A body corporate established for a public purpose by or under an Australian law

- A representative body

How is Ready to Export Defined

Ready to export is defined by the definitions of each of the Funding Tiers

- Tier 1: New export activities

- Tier 2: Expanding export activities

- Tier 3: Strategic shifts to export activities

Types of Eligible Products or Services

Eligible Products or services are broken down into 5 categories:

Goods

Australian goods as per S19 of the EMDG act are goods that are either:

- Made in Australia

- Manufactured in Australia from imported materials that undergo a process which does one of the following:

- results in the manufacture of a new product

- substantially transforms the nature of the materials or components

- is an important stage in the manufacture of a product

- Goods that are made outside Australia but where 3 of the following 4 conditions are met:

- the assets used to make the goods ready for sale are mainly based in Australia

- the activities resulting in the goods being made ready for sale are mainly carried on in Australia

- a significant proportion of the value of the goods is added in Australia

- the making of the goods directly generates significant employment in Australia.

Services

Australian services must be supplied to foreign persons and be at least 3 of the following:

- the assets used to make the services ready for sale are mainly based in Australia

- the activities resulting in the services being made ready for sale are mainly carried on in Australia

- for services supplied outside Australia – a significant proportion of the value of the services is added in Australia

- the supply of the services directly generates significant employment in Australia.

Events

Events like trade shows held in Australia are eligible if they are being held to market or promote Australian products or services to international customers.

Intellectual Property

To be an eligible product, intellectual property or know-how must be as follows:

- for intellectual property rights relating to a trade mark, the trade mark was first used in Australia, or has increased in significance or value because of being used in Australia

- for intellectual property rights relating to any other thing, or for know-how, the thing, or know-how, is the result of research or work done in Australia.

Software

To be an eligible product, software must be a work in which copyright subsists, and the work is the result of research or work done in Australia.

What We Do.

At Rimon we focus on 4 main areas when it comes to working with you on your R&D Tax Incentive and Export Market Development Grant claims:

01 Compliance

- We make it Our Business to make Your Business Compliant

- The R&D Tax Incentive and EMDG are what we do, and we do them well

- Our technical and financial experts are the top of the game

02 Your Time

- We do the work, so you can run your business

- We are a full-service outfit

- Expect efficiency and accuracy when working with the Rimon Team

03 Individuality

- Each business is different and has its own magic

- Our expert team take the time to understand Your Magic

- We deliver to Your specific needs and requirements

04 Enjoyment

- Life is short, enjoy it

- Work with a team that you have fun with

- We are just as excited to work with you

How we do it

It starts by getting a detailed understanding of who you are, what you do, and why you do it. Then, we apply our business and financial nous and proven methodology to produce an immaculate claim that is hard to ignore!

Understand our clients

Use storytelling to showcase your story

Deepdive into the product/service

Analyse the figures

Leave no stone unturned

Submit an immaculate claim

FAQs

If I miss the Application Window can I still apply?

No, if the window is missed then that grant year is lost for submission purposes

If my spend increases after I am approved can I resubmit?

Unfortunately not, once submitted the upper limit for those grant years is set

How often are the milestone payments made?

Milestone payments to be made annually

What happens if my projected marketing spend goes down?

AusTrade are able to adjust your Tier to the appropriate tier level.

Is there a minimum limit I have to spend?

There is no longer a minimum limit amount, it used to be $15,000.

Will my previous EMDG submissions get included in the new scheme?

Yes they would, your previous submissions will be added to your total tally of 8 submissions

Is foreing travel included in eligible categories and how is it claimed?

Travel is now on an expense basis, no longer $350 per day. Records need to be kept

If I enter into a funding agreement whilst my revenue is below $20mill, can I still claim if my revenue goes above $20mill during the agreement?

Yes, the initial revenue value is retained for the duration of the funding agreement.

Is the EMDG Taxable?

Lets consider 2 different types of tax:

GST

- The EMDG is not subject to GST

Income Tax - The proceeds from the grant are considered assessable income and do need to form part of your company Profit and Loss

Can expenses paid by an overseas entity in the group be claimed?

Expenses need to be incurred by the claiming Australian entity.

Payments made by a foreign entity in the group can be claimed but the expense needs to have been incurred by the Australian entity and the Australian entity needs to have funded the payment to the foreign entity.

Generally with structures such as these expert advice should be sought.

Is the EMDG a grant or tax incentive?

The EMDG is a grant and not a tax incentive.

The benefit is not derived via the tax return and the grant is not regulated by the ATO

Is the EMDG subject to GST?

No, EMDG is not subject to GST

Is the EMDG subject to income tax?

The EMDG is classified as Assessable Income and as such needs to be included in an entity’s statement of Profit and Loss in the revenue section.

As such grant monies from the Export Market Development Grant are subject to Income Tax

Contact us today

Contact Rimon Advisory today at (02) 9696 1256 to discover how the right advice can unlock new funds for greater growth and innovation for your business.