R&D Tax Incentive & Export Market Development Grant Specialists

We have built our firm around empowering entrepreneurs. Our services include:

the R&D Tax Incentive and the Export Market Development Grant

Who We Are.

Everybody loves a good story, let us share ours with you.

In 2011 a few of us decided we needed, and wanted, a change. We set out to study SMEs and Start-ups and understand their needs. We came up with our master list and something that kept sparking our interest was Funding.

We investigated different types of funding, PE, VC, Debt Funding. Government Grant Funding like The R&D Grant and Export Grant in Australia were also part of the mix.

We took a deep dive into the Startup Grant Funding landscape and realised that there was a gap for true expertise and exceptional service. This kind of excellence was missing in the industry - and we were passionate about creating a firm that could provide it.

And so, Rimon Advisory was born in 2012 and built from the ground up.

We are an R&D Tax and Export Grant consultancy.

We are proud to say that we have succeeded in building a reputation of excellence and business leading service and are known to be R&D Tax specialists.

We have offices in Sydney and Melbourne and clients countrywide. Have a look here to learn a bit more about our team.

Trust defined:

“Firm belief in the reliability, truth, or ability of someone or something.”

When working with Rimon you will be able to “copy paste” the definition of trust when asked about your experience with us.

Trusted R&D Tax Incentive Consulting Services

The R&D Tax Incentive (also known as the R&D tax credit) is a crucial piece of funding to you. And your relationship is crucial to us. From Beginning to End - we are a full service R&D Tax Credit specialists.

We do the work - so you can grow your business

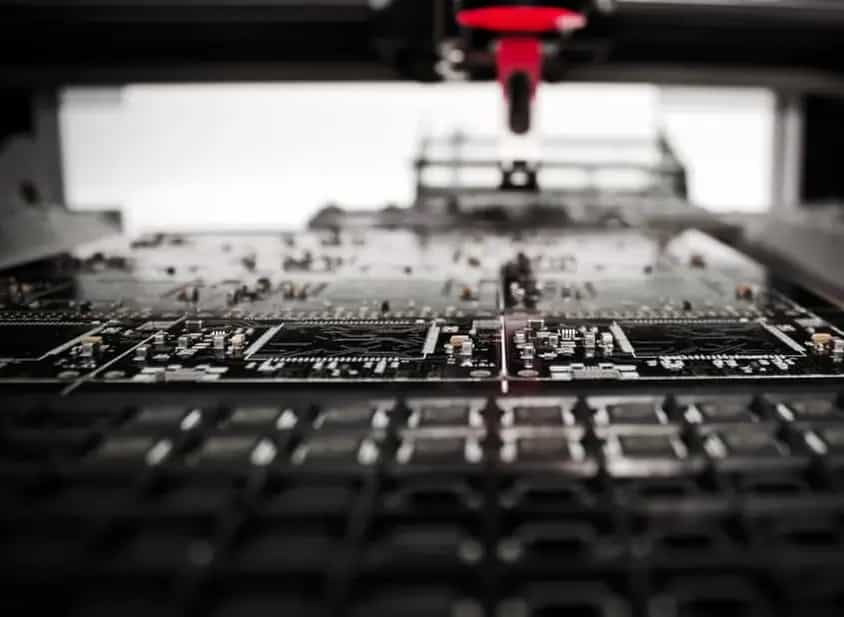

Our technical team of engineers and computer scientists will do a deep dive to understand your innovation, product, software or hardware from an R&D Tax advisory viewpoint.

Our team of R&D Tax Credit consultants work together with our technical team to put the best eligible value to your RDTI.

Industries we work with:

Manufacturing

Food & Beverage

Mining

IT & Software

Health & Medical

Tourism

Fashion

Are You Eligible?

If you are an incorporated Australian entity (Pty Ltd or Ltd) and have spent money on Research and Development in the current year or the previous year then you could be eligible for a 43.5% cash refund or tax saving on your R&D costs. by using the R&D grant in Australia.

Find out if you may be eligible:

Trusted EMDG Consultants

As an exporter the cash that the EMDG provides is a key to boost your drive for online market share.

At Rimon we understand your passion to grow and are by your side to access this funding.

Let us run the grant process and unlock your highest benefit.

We do the work - so you can grow your business.

Our Export Grant service is made up of financial experts with a huge amount of experience in their treasure chest.

We will decipher how your product or service gel with the EMDG regulations and guidelines.

We will then deliver the highest quality and eligible claim.

Industries we work with:

Manufacturing

Food & Beverage

Mining

IT & Software

Health & Medical

Tourism

Fashion

What We Do.

At Rimon we focus on 4 main areas when it comes to working with you on your R&D Tax Incentive and Export Market Development Grant claims:

-

Compliance

- We make it Our Business to make Your Business Compliant

- The R&D Tax Incentive and EMDG are what we do, and we do them well

- Our technical and financial experts are the top of the game

-

Your Time

- We do the work, so you can grow your business

- We are a full-service outfit

- Expect efficiency and accuracy when working with the Rimon Team

-

Individuality

- Each business is different and has its own magic

- Our expert team take the time to understand Your Magic

- We deliver to Your specific needs and requirements

-

Enjoyment

- Life is short, enjoy it

- Work with a team that you have fun with

- We are just as excited to work with you

How We Do It.

Understand our clients

Use storytelling to showcase your story

Deepdive into the product / service

Analyse the figures

Leave no stone unturned

Submit an immaculate claim

What our Clients Say

“I was introduced to Rimon about 5 years ago and can happily say that we have had a win-win relationship since then. Every year we are able to expand on the prior year's work. I consider them a part of our core team and our ongoing success. It's great working with grant consultants who are honest and hard working. I recommend them every chance I get.”

Michael Jankie

PoweredLocal

“I have been working with Rimon for the past 3 years. I can truly recommend these guys without any hesitation. With Rimon you will get expert advice, out of the box thinking and most importantly you will feel like you are working with trustworthy professionals.”

PsyQuation

“I just wanted to say a big thanks to you and the team for our experience in completing our R&D Grant claim with Rimon over the last 2 years. It would be great if every business we worked with could have this level of care and customer support, it’s so rare. ”

Michaela Wessels

CEO. Style Arcade

“These guys are fantastic! I am a new client, and their knowledge, attentiveness, honesty, and respect is hard to find these days. The team was very supportive and happy to answer any question in an area I knew little about. If you are looking for a team to help with grants, these guys are your answer!”

Jonathan Horne

CyberAware

“Harry and I spoke with both Gary and Gidon and I have to say, I'm really impressed with how you guys operate. You are both clearly very knowledgeable, experienced and accommodating. Looking forward to building a strong partnership in the years to come.”

Jacob King Stanley

Studio Hawk

“I just wanted to express our thanks for the great work done by the Rimon team. We’ve been extremely impressed throughout the entire project by the levels of professionalism and service. We look forward to doing it again in 12 months time!”

Malcom Treanor

WINR