Mastering R&D Project Tracking for Guaranteed Success

- By Gary Shapiro

- •

- 17 Feb, 2021

There are two major roadblocks which can often stifle the progress of a R&D Tax Incentive claim: ambiguity surrounding eligibility, and the time and effort of reflecting on the prior financial year and remembering exactly what took place, when, and who did what.

Thus, we have prepared a guide to assist you with overcoming those roadblocks and to make your R&D Tax Incentive submission more attainable in three steps.

In an ideal world you would take on board this advice prior to commencing development. However, it is never too late to get into great tracking habits and implementing these steps will be useful at any stage of a company’s R&D claim.

Step 1: Identify the project(s) that contain R&D.

In order to do this, you need to ascertain if the project contains at least one Core Activity.

The full definition of a Core Activity (and Supporting Activity) can be found here, but in simple terms, for a project to be considered core R&D it must satisfy:

-

-

- Technical Uncertainty

- Experimentation

- Generation of New Knowledge

-

If your project has at least one Core Activity, then keep reading! If not, then it is not eligible for the R&D Tax Incentive (you are still allowed to continue reading though).

Step 2: Initial planning

From the outset of a project, it must be established that new knowledge is being generated and the outcome could not have been known in advance.

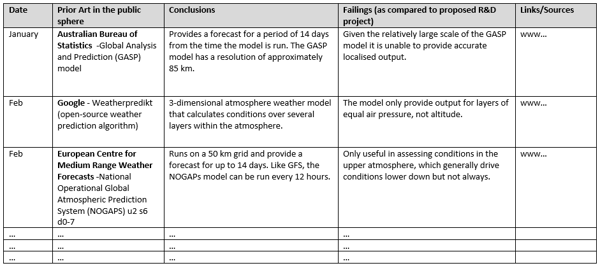

To assist our clients with this, we have prepared a document with a faux “Prior Art Review” project to provide an example of what is needed. It does not have to been in this exact format, it is just an example.

Example of establishing what new knowledge will be generated from R&D.

Example of establishing what new knowledge will be generated from R&D.

At this point you should also start with a “High-Level R&D plan”, explaining the complexity in your project and outlining the steps for the R&D activities.

Step 3: Tracking

Once the project has commenced, it is critical to regularly track it.

Ideally, someone in your R&D team, or someone involved in the R&D activity, should be assigned the role of monitoring each project at least every two weeks.

Tracking your project(s) is comprised of three components:

1. Time

-

-

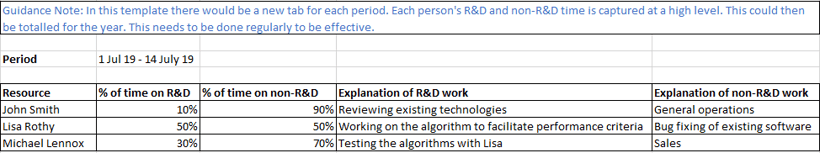

- You need to track who worked on the project and how much of their time was allocated to R&D activity. Once again, we have prepared an example template for time tracking that our clients can use.

- Alternatively, adding tags/labels to existing tracking software you may already be using will also be useful if updated regularly.

lllll

-

Example template of tracking staff, activity and time allocated.

Example template of tracking staff, activity and time allocated.

2. Activity

-

-

- It is important to track what experiments were conducted for the R&D projects and the challenges you faced.

- You could do this using a ‘R&D Plan’ document and update it fortnightly, making notes of what activity was conducted. Only 3-4 lines are required every two weeks. If you would like a copy of our ‘R&D Plan’ template don’t hesitate to reach out.

- It is also helpful to reference existing documentation you might have prepared, for example, project plans, board presentations etc.

-

3. Finance

-

-

- In your financial system you need to diligently record specific costs incurred relating to the R&D project and activities.

- In your financial system you need to diligently record specific costs incurred relating to the R&D project and activities.

-

If you are disciplined in tracking your R&D projects and follow the above steps, by the end of the financial year you will have perfectly positioned your company for a compliant and seamless submission.

In essence, the short term pain of fortnightly tracking will be significantly overshadowed by the long term gain of not having to scramble for 12 months’ worth of required documentation as the deadline is approaching.

Of course, a R&D Tax Incentive claim will also require technical and financial reports, which a trusted R&D Consultant can prepare on your behalf. However, all reporting will be enhanced and streamlined by strong tracking foundations.

If all of this has you thinking how great it would be if software was developed for the specific purpose of tracking R&D activity for the R&D Tax Incentive in a manner that was reliable, compliant and easy to use, then you will be thrilled to know that it exists!

Rimon Advisory has developed a Jira plug in called "Tracka" which can easily integrate with your Jira Projects. If you are interested in utilising this software, reach out to the Rimon Advisory team.

If you're looking to make the most of the R&D Tax Incentive and boost your innovation initiatives, we're here to assist. Our experienced team can help you navigate the nuances, ensuring you meet the eligibility requirements and capitalise on the benefits this incentive offers. Whether you're a startup, an established enterprise, or anything in between, we're committed to helping you navigate the path and propel your innovation journey forward.

Rimon Advisory’s experienced consultants can help your company submit a R&D Tax Incentive claim at every step of the way, from tracking your project on day one, to submitting your application, and everything in between.

Gary Shapiro is the Co-MD at Rimon Advisory, a leading Australian R&D Tax Incentive and Export Market Development Grant consulting firm.

He is a qualified engineer and is a registered Tax Agent. Gary is also currently a PhD candidate at the University of Sydney in the Faculty of Engineering.